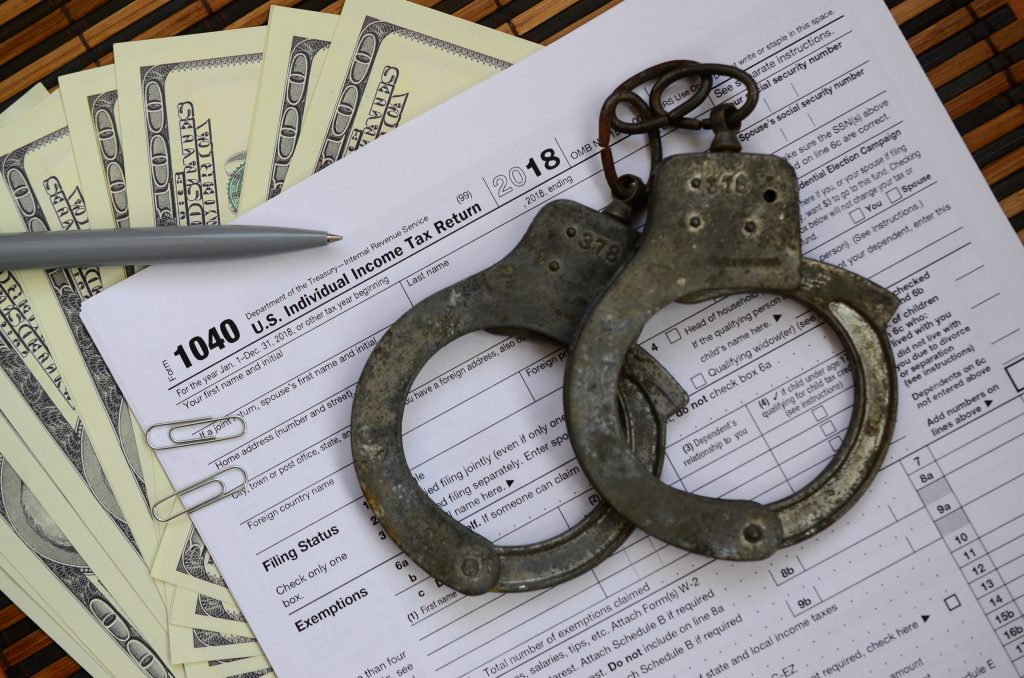

Occasionally, we get asked the question if traditional re-roofing expenses also qualify for the 26% solar Federal ITC program and we’ve always been clear with our customers that re-roofing does NOT qualify for the solar tax credit.

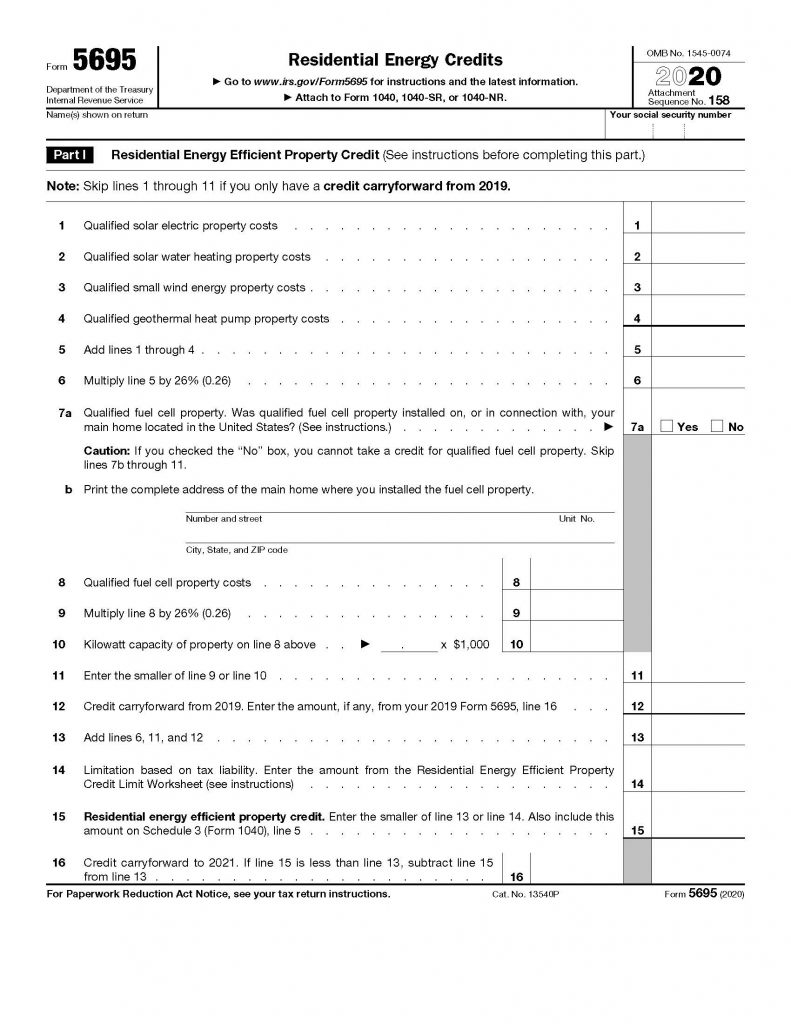

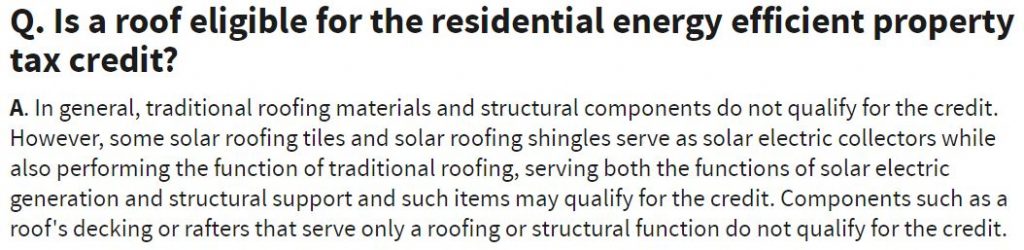

The IRS’s website is very straightforward about the intention and limits on what is eligible for the solar Federal Tax Credit.

The Federal ITC program for solar started in 2006 with the intention to incentivize people to go solar, not to re-roof their house. The ITC’s been successful, helping stimulate the economy by creating new jobs in the solar installation and manufacturing industries and it’s also helped drive the cost of solar down about 90% in the past decade. Similar incentives are not needed in the well-established roofing industry.

As noted by the IRS, solar roofing shingles like the Tesla roofing shingles will qualify for the Federal Tax Credit as they should because they generate clean, renewable electricity. Traditional roofing (composition, shake, metal, tile) does not produce electricity and is not eligible for the ITC.

What is eligible? All of the equipment, labor, permits and related electrical/structural costs needed to make the solar project work. For example, if an electrical panel needs to be updated/replaced, those equipment, labor and permit fees qualifies for the Federal Tax Credit. Similarly, if a trench needs to be dug for a long conduit run for a ground-mount solar project, those costs are also eligible for the solar Federal Tax Credit. Typically, our customers simply take the total cost of their solar project (equipment, labor, permits, necessary upgrades) listed on their receipt and use this information when filing their taxes.

We’ve worked hard since 2001 to be a trustworthy company by following the rules, being honest and transparent with our customers. We love our customers and won’t put them in harm’s way by suggesting they mislead the IRS by claiming costs that aren’t related to the solar project.

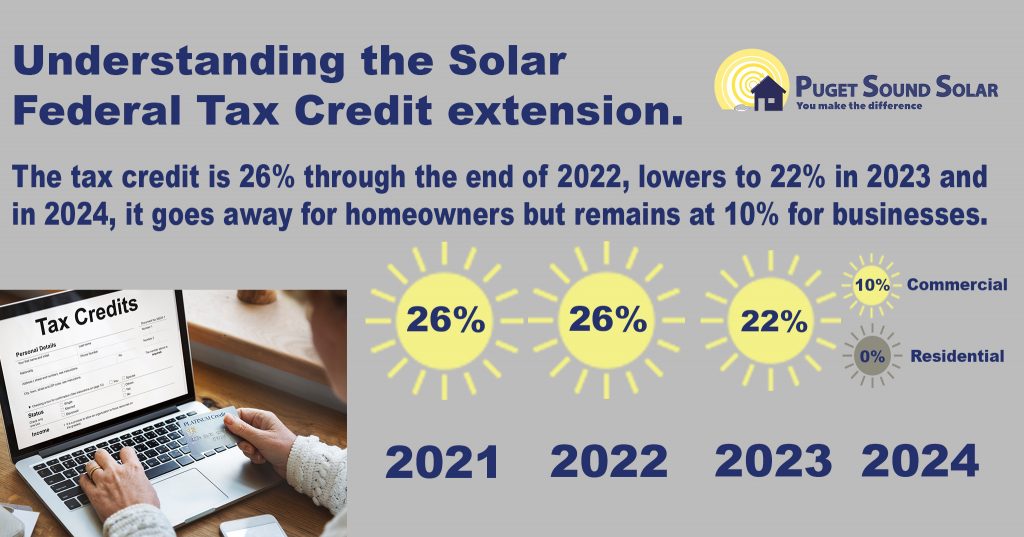

FYI, the ITC has been extended a couple of times, most recently in January 2021 for two more years. The current schedule for the ITC stepdown is:

When you’re ready to get some accurate information about the costs and benefits of going solar, give the most experienced solar installation company in town a call. Our solar consultants will provide you with a free solar quote outlining all the current financial incentives and calculations you’ll need to make the decision about whether solar is right for you.

Give us a call at 206-706-1931 or fill out the contact form below to get started and find out why we’ve been trusted by thousands of homeowners and businesses with their solar projects since 2001.