As we approach Global Climate Strike Day, the fall equinox and the final quarter of 2019, the realization that the Investment Tax Credit (ITC) for solar installations (including equipment, labor and any related electrical work) is scheduled to decrease and completely go away over the next few years is getting the attention of businesses and customers who want to go solar.

Since 2005, solar customers (and the environment) have benefited from the 30% tax credit. It’s helped projects pencil out, letting people make the shift to clean energy. It’s been partially responsible for the scaling up of the solar industry and bringing overall prices down, including the cost of materials.

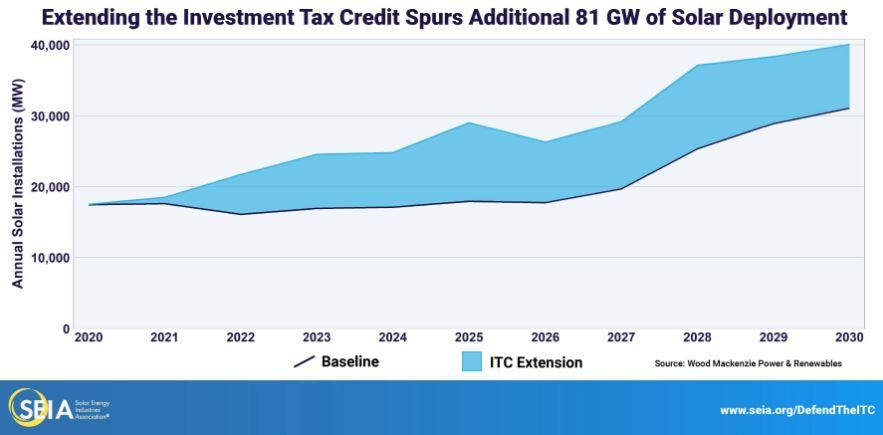

The current 30% tax credit begins a step down at the end of 2019 to 26% in 2020, 22% in 2021 and then it completely goes away in 2022 for residential customers. Commercial solar projects will continue to receive a 10% tax credit in perpetuity based off the current legislation. With a five-year extension of the ITC, it’s estimated that an additional 81 gigawatts of solar can be deployed by 2030, offsetting 363 million tons of CO2 emissions.

Proposals for extending the ITC are being discussed by members of both parties in Congress however the current state of affairs in politics makes anything unsure. There are a multitude of reasons to support extending the solar tax program including the reduction of carbon emissions that lead to climate change. The ITC has helped jobs in the solar industry expand by 10,000% and an annual 50% increase in each of the past five years alone.

We’re encouraging our prospective customers to install their solar project before the end of 2019 to ensure they get the best deal possible. We’re also telling everyone to contact your Congressional representative(s) to let them know you support an extension of the Federal solar tax credit. The most commonly discussed proposal suggests extending the ITC out five more years with the same step-down process and percentages.

How about taking a step for the planet on Climate Strike day and reach out to your Congressional representatives to let them know you support an extension of the Solar Investment Tax Credit program.

After that, take a second step and give us a call or fill out our web form to get a free quote for solar and be part of the solution to climate change.