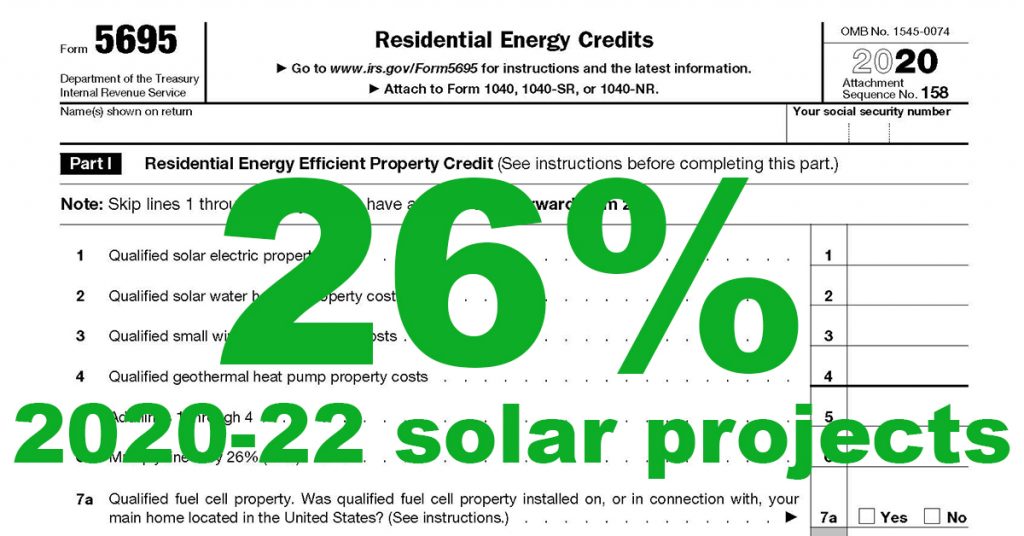

If you installed solar in 2020, don’t forget to file for the Residential Energy Efficiency Tax Credit, using Form 5695. It’s quite simple and it’s usually valued at several thousand dollars, so it’s well worth your time. This tax credit is also known as the “solar tax credit” but it also applies toward energy storage like a Tesla PowerWall, Enphase Ensemble and LG RESU Chem battery systems (if installed with solar). The tax credit is equal to 26% of the entire cost of your solar PV and energy storage installation – including materials, labor, permits and any related electrical or structural work* required to hold the solar (like a new carport, a ground mount system, etc…) *Re-roofing does not qualify for the tax credit.

April 15th is the traditional due date for submitting tax information each year. Due to the pandemic, this years deadline was extended to May 17th.

You can download form 5695 or learn more about Residential Energy Credits on the IRS website.

A reminder that the tax credit level of 26% was extended by two years as part of the comprehensive pandemic economic stimulus bill so homeowners who go solar in 2021 and 2022 can get 26%. It lowers to 22% in 2023 and then goes away completely for homeowners in 2024. Businesses will still be eligible for a 10% tax credit from 2024 on.